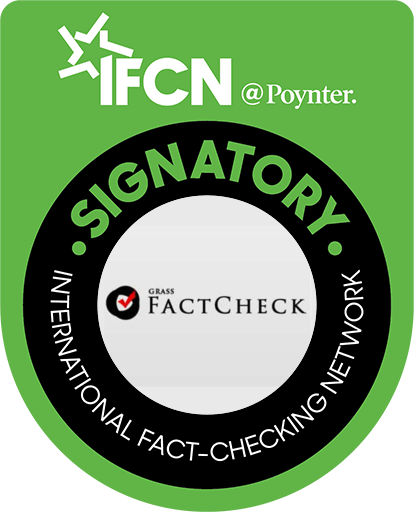

As of 31 December 2022, the total amount of assets of both the Bank of Georgia and TBC Bank is GEL 55.8 billion which accounts for 79.3% of the total bank assets. At the same time with a GEL 1.959 billion total profit, their share in profits was 93.8%.

The fact that the Bank of Georgia and TBC Bank hold a dominant position is evident even without processing statistical information. Most of the country’s employees have their salary accounts in one of these two banks, loans and deposits are mainly issued and received by these banks and payment terminals in shops and restaurants are mostly owned by these two banks. Further, both have branches throughout the country (except for the occupied territories). Despite its high number of branches and customers, Liberty Bank, which is ranked third in terms of assets, cannot offer any real competition because its main segment consists of pensioners and low-wage workers in the budget sector.

The portfolio for Bank of Georgia and TBC Bank shares in credits and deposits (also including current accounts) is almost the same as in assets. In terms of net profit, it is even higher and exceeds 93%. One of the reasons for the increased share of profit was VTB Bank ending its reporting period with a loss.

Bank of Georgia and TBC Bank also had a dominant position in the previous years but they were unable to control four-fifths of the entire market. As of 31 December 2012, the total value of the banks’ assets was USD 14.4 billion. Of this amount, Bank of Georgia’s share was GEL 5.7 billion and TBC Bank’s share was GEL 3.9 billion which made the total deposits valued at GEL 9.5 billion – some 66.7% of the total assets. After five years, the share of these two banks was as high as 73.7% as of 31 December 2017.

Graph 1: Share of Commercial Banks as of 31 December 2022

Source: National Bank of Georgia

Bank mergers are the reason for the two banks having more dominant positions. In 2014, Privat Bank was acquired by the Bank of Georgia whereas TBC Bank purchased Bank Republic in 2016. Basis Bank was also interested to purchase Bank Republic but the deal eventually failed.

After the imposition of the international sanctions in 2022, part of VTB Bank’s portfolio was distributed between Basis Bank and Liberty Bank. As a result, these two banks became even stronger as compared to the other small banks, although the positions of the two largest banks were not weakened.

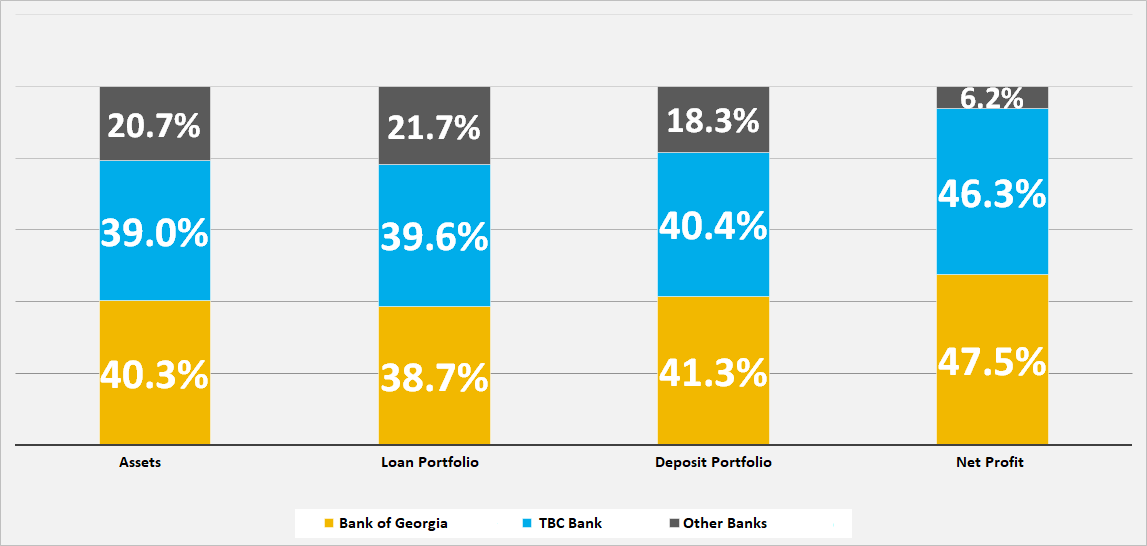

In contrast to Georgia, no two banks own an 80% share in any other European countries. However, as reported by the TheBanks.EU, the share of the two largest banks exceeds 50% of the market in some cases.

Table 1: Share of Banks in the Entire Banking Sector in Terms of Assets

Source: TheBanks.eu

Since a commercial bank’s principal activity is lending and the bulk of its assets are loans, the share of the credit portfolio of any bank is almost the same as the share of its total assets.

Economists and finance specialists frequently point out the high concentration in Georgia as a problem. However, the situation in this regard has not been improving and, on the contrary, the dominant share of the two largest banks has increased from 66.7% to 79.3% in the last ten years. Local banks are unable to grow independently and foreign banks are leaving Georgia. In 2011-2016, the UK’s HSBC, Ukraine’s Privat Bank and the French Société Générale (Bank Republic) left the country. Although the rate for the equity (ROE) ratio is higher in Georgia’s banking domain as compared to Europe, international players do not take interest in the market except for purchasing shares in Georgian banks.